Many British people still assume Inheritance Tax (IHT) is a distant threat, something for the super‑wealthy or “somebody else.”

The reality is different. Frozen thresholds and rising asset values mean more ordinary families are being drawn into its net every year. Ignoring the issue is not a strategy, it’s a costly mistake.

How Much Has Inheritance Tax Increased in the UK?

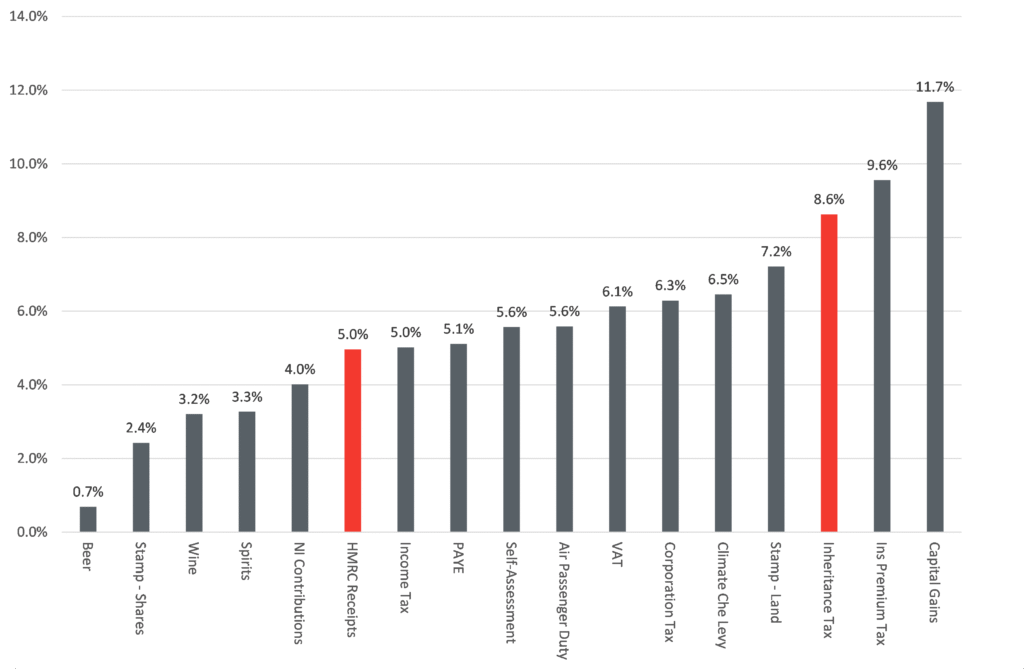

IHT was formally introduced in 1986, with an original intent to tax the wealthiest estates. Over time, frozen thresholds and rising asset prices have expanded its reach. Since the Global Financial Crisis (2009/2010), IHT has been the third fastest growing source of tax for HMRC (Chart 1). Compound annual growth has been +8.6%, versus general HMRC receipts at +5.0%.

Chart 1: 15-year Compound Annual Growth Rate (CAGR) in tax receipts by type

IHT receipts have grown at more than double the pace of the UK economy over the past 15 years. The +8.6% CAGR compares to nominal GDP growing at +4.2% and inflation (CPI) around +2.9%, well above the Bank of England’s stated target of 2.0%.

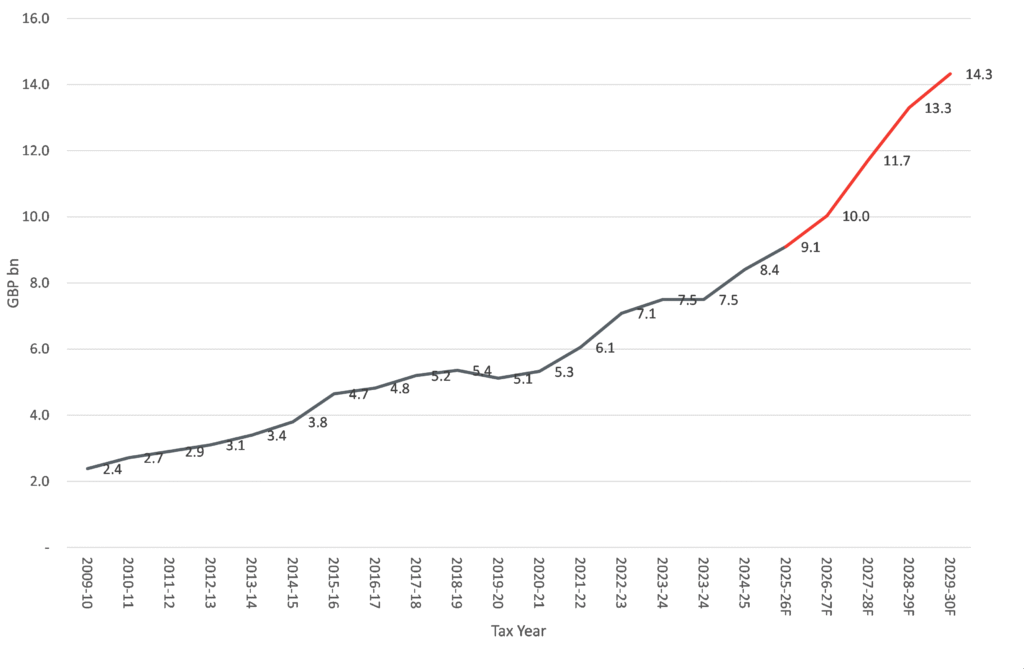

More is to come. As Morenti Wealth’s Chris Bourne emphasized in his recent YouTube video, the Office for Budget Responsibility (OBR) has forecast that IHT receipts will increase to £14.3bn in the 2029/30 tax year (see Chart 2), in part due to changes in treatment of pensions.

Chart 2: OBR Inheritance Tax Receipts Forecast (2026-2030)

The OBR forecast implies a CAGR of 11.2% to 2030, in other words, growth in IHT receipts is expected to accelerate even further. Whilst ultra precise forecasts like this will always prove wrong in the long run, the direction of travel should be heeded. Forewarned is forearmed.

So, who’s really paying the price?

What Size Estates Pay the Most Inheritance Tax?

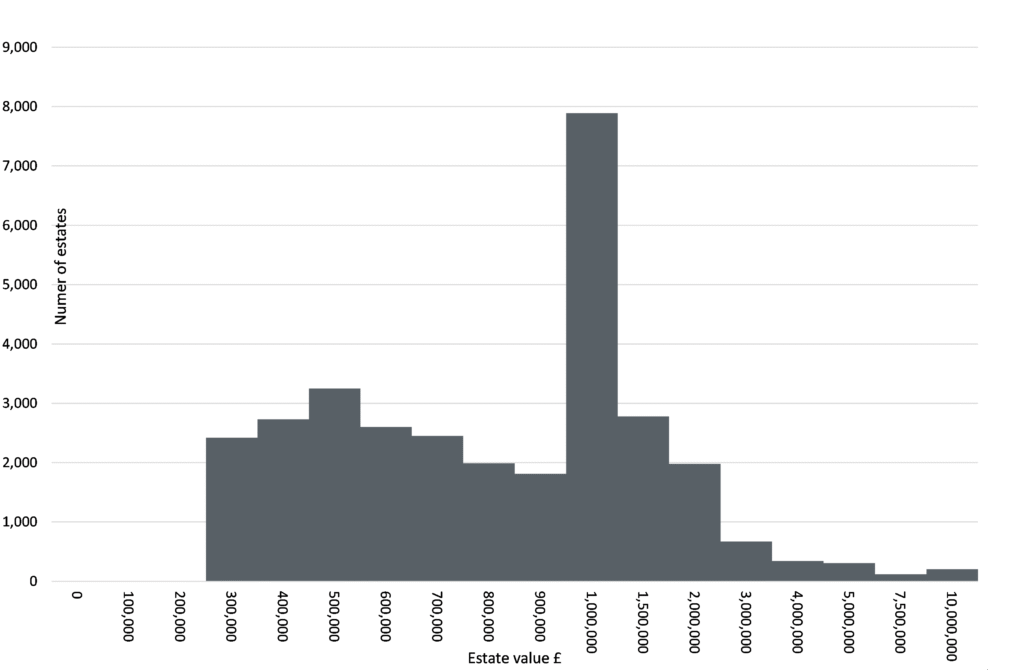

HMRC’s latest data for 2022/23 reveals who is most vulnerable to IHT.

It may come as a surprise to our readers that the largest cohort that pay IHT by volume are those leaving estates of greater than £1m but less than £1.5m (see Chart 3) in value.

Some 7,890 estates were trapped in this category in the 22/23 tax year, around ~25% of estates paying IHT. In fact, ~95% of estates paying IHT had a value of £2m or less.

Chart 3: Histogram of volume of estates paying IHT by net estate value ‘category’

Those with net estates of greater than £5m (322 people) were just ~1% of estates caught by the IHT net. The data lends support to Leona Helmsley’s infamous adage ‘We don’t pay taxes, only the little people pay taxes[1]’. Wealthy families plan ahead, and the data shows it pays to do so. The Duke of Westminster, Hugh Grosvenor, one of the UK’s richest people, reportedly reduced IHT on his £9bn inheritance[2], through the legal and responsible use of a Trust.

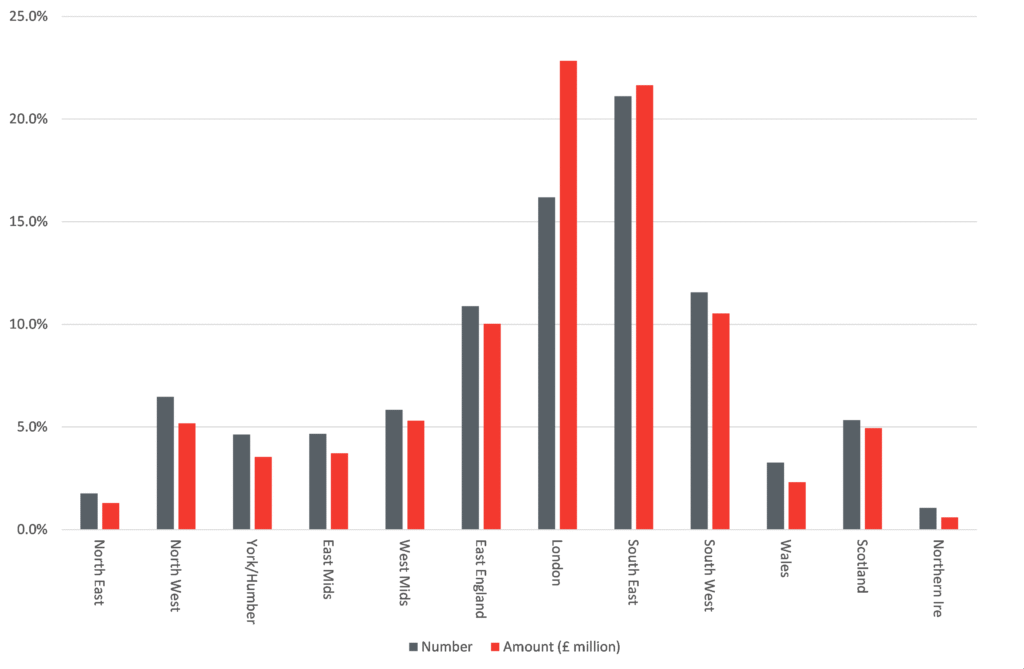

HMRC data also allows us to scrutinize IHT receipts by geography (see Chart 4) for the 22/23 tax year. Estates in London, and the South East more generally, dominate both the number of estates paying IHT (~37% of all estates) and the total contribution by value (~44% of all IHT receipts). This is disproportionate to the number of households in London and the Southeast relative to the rest of the UK. Rapid increases in property price values are likely a key driver.

High home prices are not isolated to either London or the South East. Across the UK, from Cheshire and Harrogate, to Salcombe, Sandbanks, Lustleigh and the Wittering’s in the Southwest, to Edinburgh’s New Town and East Lothian, this is a widespread phenomenon.

[1] See: https://en.wikipedia.org/wiki/Leona_Helmsley

[2] See: https://www.tax.org.uk/blog-behind-the-headlines-on-the-duke-and-all-that-money

Chart 4: IHT liability by region

As noted by the OBR, known changes to UK inheritance tax rules (UK Finance Bill 2025-26), that require both defined benefit and defined contribution pensions to be included in individual’s taxable estate calculation from the 6th April-2027, will exacerbate this trend.

What Happens If I Don’t Plan for Inheritance Tax?

As legendary US investor Warren Buffett has observed, “Risk comes from not knowing what you’re doing.” His long-term partner, Charlie Munger, called it “incentive-caused bias”, the emotional cost of confronting uncomfortable truths.

Most families delay IHT planning because it forces uncomfortable conversations about death, control, and fairness. This procrastination is costly.

When you ignore estate planning, you’re not just leaving money on the table, you’re leaving control to the UK government. The compounding of inaction is real, and irreversible.

Do I Need a Financial Adviser for Inheritance Tax Planning?

This is where independent advice makes the difference.

Firms like Morenti Wealth specialize in intergenerational planning, helping clients use tax allowances, trusts, business reliefs, family investment companies, and pension structures to mitigate inheritance tax exposure.

Our focus is cross-market and technical, leveraging our collective experience, rather than being product or sales-focused.

For avoidance of doubt, this isn’t about avoidance.

It’s about foresight, stewardship, and proactive financial planning.

Advice tailored to your family circumstances can reduce exposure by millions over generations. Morenti Wealth uses a variety of well-trodden, well-understood pathways to assist clients in navigating an increasingly challenging IHT landscape.

In our experience robo-advisers and DIY approaches can struggle to provide the nuanced, bespoke guidance required to navigate the IHT maze. Even for highly financially literate clients, with long careers in Banking, Insurance, Investment Management and general business, we are trusted advisors, providing wise counsel and acting as a seasoned set of eyes on existing plans.

We recognize that true value lies in understanding the family and detailed cash-flow modelling, incorporating substantive A/B testing and ‘What If’ style analysis.

At Morenti Wealth, our role is to help clients preserve and pass on their wealth with clarity, confidence, and care. For many families, the first step is simply to start the conversation.

How Do I Start Reducing My Inheritance Tax Bill?

Denial may be comfortable, but it’s also expensive.

With thresholds frozen, changes to pension inheritance rules and the value of assets rising, more families will be dragged into the IHT net. Without preparation, your family could face a 40% tax bill on your work.

The good news? It’s manageable. The tools exist. So do the experts.

Talk to Morenti Wealth. Prepare your legacy while you still have control over it. Because denial isn’t a strategy, it’s a liability that planning can prevent.

If you would like to receive more information from Morenti Wealth, including our latest research and insights sent directly to your inbox, please click here.

You may also be interested to read Chris Bourne’s recent article on this very subject; ‘This Strategy Saved a Client £105k in Projected Tax’, where he shows a case study of a client who reduced his family’s IHT burden by using a specific type of trust.

About Morenti Wealth

Morenti Wealth is a trading style of Burgess & Lee Ltd, an independent financial advice firm specialising in retirement and inheritance tax planning. Morenti Wealth focuses on delivering clear, actionable strategies tailored to clients’ unique goals, stripping away unnecessary complexity and costs. Burgess & Lee is authorized and regulated by the Financial Conduct Authority (FCA).

Disclaimer

This report is for information only and does not constitute personal financial advice. We strive to provide accurate and up-to-date information, but investments carry risks, including the potential loss of capital. This article does not consider your individual circumstances. You should seek personalised advice before making financial decisions.