My client Keith has a large pension pot, and he will be significantly impacted by the rule changes making this money subject to inheritance tax from April 2027. He wanted to lessen the impact of the tax and asked my advice on how to do it.

There are of course many ways of achieving that aim depending on your exact goals, need for access to money and other circumstances. Having discussed Keith’s in detail we decided on one particular course of action, but it’s important to consider your own position and take personal advice if necessary before making decisions. Here’s how this strategy helped Keith and his family…

His pension was valued at around £1.8m, so he was well past the point where his tax free lump sum could grow further. Regardless of any more pension gains, the lump sum was stuck at £268,275 – the Lump Sum Allowance.

He still wanted to personally benefit from his tax free payment though – he’d worked hard for it, and although IHT was a concern, he wasn’t keen on giving it away and paying tax on all his pension income.

So, I suggested we could take his lump sum out and place it into something called a loan trust.

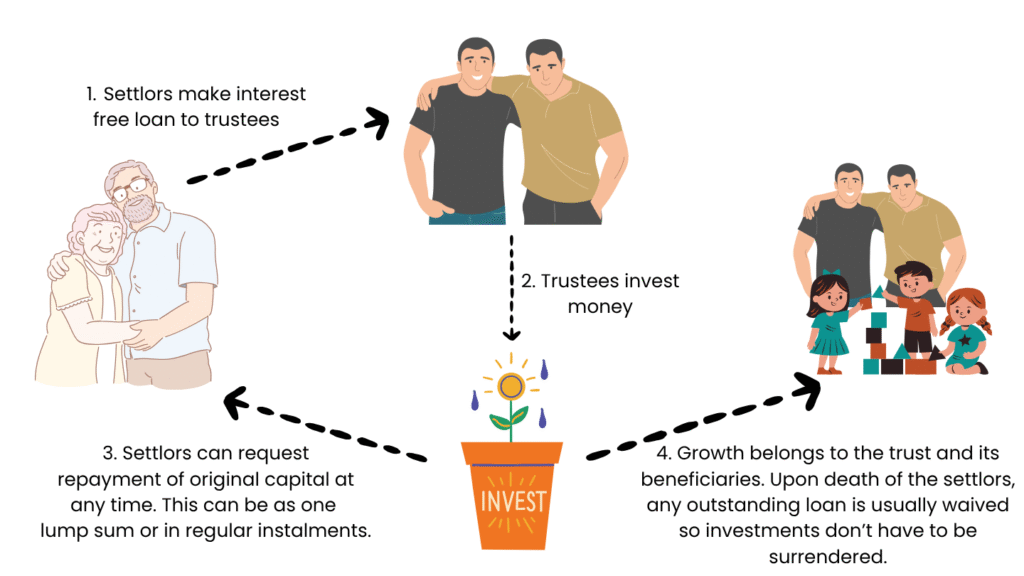

How Does A Loan Trust Work?

The person who creates a trust is called the settlor, and I explained to Keith we could set this up with him and his wife Sue as joint settlors.

Trust terminology can get a bit stodgy, but what happens with a loan trust is that the settlor or settlors make an interest free loan to a person or people who are responsible for looking after the money, called trustees. Settlors are automatically trustees, but it is always advisable that additional ones are added. In this case, Keith and Sue also appointed their adult sons.

Once money has been loaned to the trustees, they then invest it, but the settlors can ask for their original capital back at any time. All growth achieved by the investments however, belongs to the beneficiaries of the trust, which the settlors are able to choose at outset.

With an absolute or bare trust, the beneficiaries are named, and they cannot be changed after the trust is set up. With a discretionary trust, there are various ‘classes’ of beneficiaries who are able to benefit, including children and grandchildren, and the trustees can exercise discretion over who benefits, how much they benefit, and when.

Fig.1 – Basic Structure of a Loan Trust

In this case it was a discretionary trust, so the beneficiaries would naturally include Keith and Sue’s sons, but also their grandchildren, with the trustees able to decide as they see fit.

The primary benefit of the trust in this case is that it would keep any gains on the investments outside of the settlors’ estates, meaning they don’t pay any inheritance tax on those gains.

How Can Money Be Invested in a Loan Trust?

I recommended that the money was placed into a type of investment account called an offshore bond, because it provided some very useful tax planning features. I released a video recently where I explain these features in more detail, which you can view here.

The money in the offshore bond account would be invested in exactly the same way as Keith’s pension money, so the growth potential remained the same, but a bond does have slightly higher charges than a pension. One could typically expect to pay around 0.30% a year more on average for an offshore bond, but it could be more or less depending on the provider, the investments chosen and the amount invested.

What Keith and Sue were then able to do is use one of the features of a bond, which allows you to separate the original capital from the growth, and take 5% of that initial investment back every year as a return of capital, with no tax on it.

So, in much the same way as Keith may have taken tax free cash gradually over a number of years, he and Sue could continue to do the same, in a tax efficient way. All the while, these withdrawals would reduce the value of the investment in their estate for IHT, because they would be spending capital, and all the growth would belong to the trust instead of accumulating in their estate.

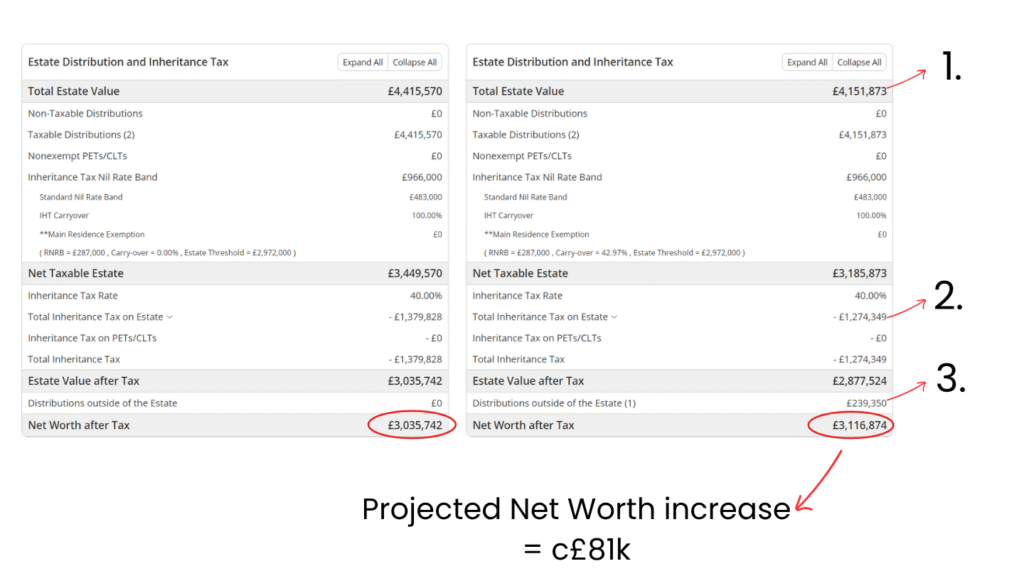

What Tax Impact Does The Loan Trust Have?

When I modelled this out for them, it made a significant difference to the future projected value of their estate… As we can see from the projected tax summary below, the original scenario where Keith left the money in his pension gave a projected net legacy value of £3,035,742, but with these proposals modelled in, including the higher charges of the bond (modelled at +0.30%), that projection improved to £3,116,874… An £81,132 increase. The table below shows the base plan on the left, and the loan trust scenario on the right.

Fig.2 – Projected IHT Position with Loan Trust

The first thing to notice is that the total estate value in the loan trust scenario is lower than the base plan (1), this is because capital has been taken out of the estate and spent. This results in a projected IHT saving of some £105,479 (2). The value of the trust, which is growth achieved on the investments, is then a ‘distribution outside of the estate’ (3), leading to the improved total legacy.

It’s important to remember that projections like the ones shown are not guaranteed. We cannot know the level of growth that will be achieved, or what tax rates and allowances will be in the future. However, projections do show a ‘direction of travel’, and how your individual position can be improved. You are able to access the tools used in creating these projections yourself via my Voyant masterclass courses. If you would like to explore these, click here.

About Morenti Wealth

Morenti Wealth is a trading style of Burgess & Lee Ltd, an independent financial advice firm specialising in retirement and inheritance tax planning. Morenti Wealth focuses on delivering clear, actionable strategies tailored to clients’ unique goals, stripping away unnecessary complexity and costs. Burgess & Lee is authorized and regulated by the Financial Conduct Authority (FCA).

Disclaimer

This report is for information only and does not constitute personal financial advice. We strive to provide accurate and up-to-date information, but investments carry risks, including the potential loss of capital. This article does not consider your individual circumstances. You should seek personalised advice before making financial decisions.